Gynecomastia insurance coverage in India depends on whether the condition is viewed as a “medical/functional” issue or purely cosmetic. While cosmetic gynecomastia surgery alone is generally not covered, many health insurers may approve claims if the breast enlargement causes pain, infection, functional impairment, or significant discomfort. Gynecomastia — commonly called “manboobs” — affects a large number of men in India and can lead to emotional stress, low confidence, and physical symptoms. Male breast reduction surgery (gynecomastia surgery) offers a long-term solution, and this guide explains when insurance applies, what documents are required, and how to file a successful claim.

What Is Gynecomastia & Why Does It Happen?

Gynecomastia surgery includes the elimination of extra fat & gland from the male chest to create a gynecomastia-free, more masculine chest contour. The procedure is usually performed by a qualified plastic or aesthetic surgeon under anesthesia.

The surgery has both aesthetic and psychological benefits; insurance companies in India often categorize it as an aesthetic procedure, and that’s how the confusion starts.

Is Gynecomastia Surgery Covered Under Insurance in India?

Generally, gynecomastia surgery is not covered under standard health insurance plans in India. This is because insurance companies usually classify it under the aesthetic surgery category, which they do not reimburse.

According to the Insurance Regulatory and Development Authority of India (IRDAI), health insurance policies typically cover surgeries that are “medically important” not those done for aesthetic reasons.

Since gynecomastia surgery is most of the time perceived as an aesthetic correction rather than a medical necessity, insurance companies may reject claims for it.

When Gynecomastia Surgery Can Be Covered Under Insurance

In certain cases, gynecomastia surgery insurance can be valid & approved if the surgery is done for medical reasons rather than cosmetic ones. Some examples are:

Hormonal Imbalance or Endocrine Disorder

If gynecomastia is due to a hormonal imbalance or medical condition and a doctor certifies it as medically necessary, insurance providers may cover the surgery.

Pain or Physical Discomfort:

Some men experience pain, tenderness, or physical restriction in doing daily activities due to enlarged breast tissue. If these symptoms are documented well and recommended for surgical correction by a certified doctor or specialist,then you may claim your insurance for gynecomastia surgery.

Post-Treatment Conditions:

In rare cases, gynecomastia may result from medication side effects or certain diseases. When the surgery is part of the recovery process, insurance companies may accept the claim.

Note: These approvals are rare and depend heavily on your insurance provider and the documentation submitted.

How to Get Gynecomastia Surgery Covered by Insurance in India

If you believe your case qualifies for insurance coverage, follow these steps carefully to claim your insurance:

- Consult a Qualified Plastic Surgeon:

Get an official diagnosis and a recommendation letter stating that the surgery is medically important. - Check with Your Insurance Provider:

Contact your insurer to confirm whether gynecomastia surgery coverage is possible under your plan. - Collect Proper Documentation:

Keep all medical records, diagnostic tests, and the doctor’s recommendation letter. These documents strengthen your case for claim approval. - Submit a Pre-authorization Request:

Before the surgery, ask your hospital to send a cashless authorization request to your insurance provider. This helps you know if the procedure can be covered in advance. - Keep the Invoices and Bills:

Even if you pay for the surgery yourself, keep all detailed bills, operation notes, and discharge summaries. Some patients have successfully received reimbursement later through medical claim insurance for gynecomastia.

Why Cashless Gynecomastia Surgery Is Rare

Most hospitals in India cannot provide cashless surgery for gynecomastia, because insurers do not list it as a covered procedure. You will usually need to pay upfront and later apply for reimbursement, provided your claim is accepted.

Doctors or clinics that promise 100% insurance coverage for gynecomastia are not being truthful, as doing so can be considered insurance fraud. Always go through legitimate medical and insurance channels.

Alternative Payment Options – EMI and Medical Loans

If your insurance does not cover the surgery, don’t worry. Many reputed clinics offer 0% interest EMI options or medical loans for gynecomastia surgery.

You can choose to pay in 6-month, 12-month, or even 24-month installments.

If you’re struggling with gynecomastia and looking surgery in Delhi, don’t let insurance confusion hold you back. Speak to an experienced plastic surgeon, explore EMI options, and take the first step toward feeling confident again.

What Insurance Officers Check Before Approving Gynecomastia Surgery Claims

Since gynecomastia surgery is usually considered cosmetic, insurance officers look for strong proof of medical necessity before approving a claim. They mainly evaluate the following:

1. Physical Symptoms

Insurers check whether gynecomastia is causing real phys ical issues such as:

Chest, neck, or back pain

Skin irritation or infections under the breast fold

Posture problems

Difficulty with exercise or daily activities

2. Medical Proof of True Gynecomastia

To confirm it’s not just fat (pseudogynecomastia), insurers require:

Plastic Surgeon’s physical examination notes

Diagnostic tests (ultrasound, mammogram, CT/MRI)

Biopsy/pathology reports if available

3. Failed Non-Surgical Treatments

They look for evidence that conservative steps didn’t work:

Unsuccessful weight loss or exercise attempts

Hormonal treatment or medication trials

Discontinuation of gynecomastia-inducing drugs for 6–12 months

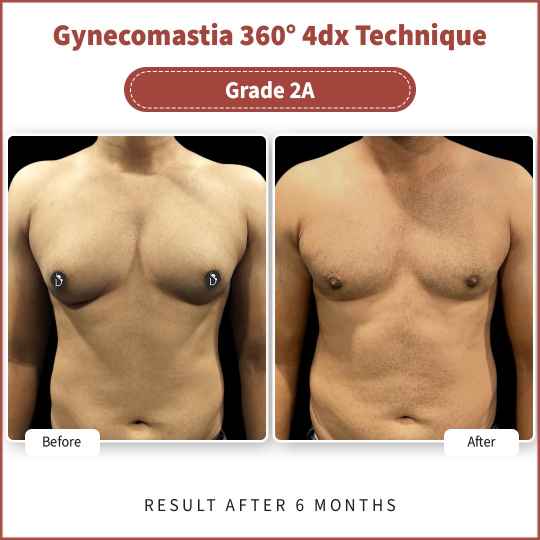

4. Duration & Severity

Insurance approval is more likely when:

The condition has lasted 2+ years (adults)

Symptoms continue 1 year after puberty (teens)

Gynecomastia is Grade 2, 3, or 4

5. Additional Supporting Documents

Officers may request:

Reports from your primary doctor or endocrinologist

Physiotherapy notes for posture-related pain

Clear photographic evidence

Mental health documentation (rarely decisive)

The insurance officer reviews all documents to decide if your case qualifies as medically necessary according to policy rules.

Most health insurance plans classify gynecomastia surgery as cosmetic and don’t cover it, but if you can demonstrate that the condition causes significant physical symptoms or functional impairment, some providers may consider coverage on a case-by-case basis.

Book Your Free Consultation Now

Conclusion

For most patients, insurance companies classify gynecomastia surgery as a cosmetic procedure, not medically necessary. Therefore, approval depends heavily on documentation, diagnosis, and policy terms. For detailed guidance on what insurance officers check before approving claims, read the complete article above to understand how to strengthen your case and explore safe, transparent options.

If you’re dealing with gynecomastia or want a permanent male chest correction, Divine Cosmetic Surgery is the most reliable choice. Dr. Amit Gupta, India’s leading expert, uses advanced 360° VASER lipo and gland removal to deliver natural, long-term results. Book your consultation today!

Faqs

Q1: What documents are required to claim insurance for gynecomastia surgery?

Medical reports, surgeon’s recommendation, diagnostic test results, and a pre-authorization request.

Q2: How much does gynecomastia surgery cost in India?

Costs typically range from ₹35,000 – ₹85,000 depending on severity, technique, and surgeon.

Q3: Is gynecomastia considered cosmetic or medical?

Gynecomastia surgery is usually considered a cosmetic procedure, though it may be classified as medical if it causes pain, functional impairment, or is linked to an underlying condition.

Q4: Can I claim insurance for pain caused by gynecomastia?

Yes — if you can document significant pain, discomfort, or restriction caused by gynecomastia and show it is medically necessary, some insurers may consider covering it.

Q5: Are there conditions where insurance always approves? e.g., infections?

Insurance may approve coverage when gynecomastia is clearly associated with medically documented conditions such as hormonal disorders or tissue pain, but no condition is guaranteed to be always covered.

Q6: How long does the approval process take?

Approval time varies by insurer and documentation completeness, but starting pre-authorization well before surgery can help speed up the review.

Q7: Does insurance pay full surgery cost?

Insurance may pay full or partial costs only if the procedure is deemed medically necessary; many plans still require patient co-payment or may deny cosmetic portions of the surgery.

Q8: What policies commonly cover it?

Some comprehensive or higher-end health insurance plans may cover gynecomastia if it’s medically justified, while most standard policies exclude it as a cosmetic procedure